Bagley Risk Management Solutions: Your Shield Against Uncertainty

Bagley Risk Management Solutions: Your Shield Against Uncertainty

Blog Article

Just How Livestock Threat Security (LRP) Insurance Policy Can Protect Your Animals Investment

Livestock Danger Defense (LRP) insurance stands as a trusted guard versus the uncertain nature of the market, supplying a critical strategy to protecting your assets. By delving into the intricacies of LRP insurance and its diverse advantages, animals producers can fortify their investments with a layer of security that goes beyond market variations.

Recognizing Animals Threat Security (LRP) Insurance

Recognizing Livestock Threat Security (LRP) Insurance policy is essential for animals manufacturers seeking to alleviate monetary risks linked with price variations. LRP is a federally subsidized insurance policy product made to safeguard manufacturers against a decline in market costs. By giving insurance coverage for market value decreases, LRP helps producers secure a flooring price for their animals, making sure a minimum level of income despite market changes.

One secret element of LRP is its flexibility, enabling producers to tailor insurance coverage degrees and policy lengths to match their specific requirements. Producers can pick the variety of head, weight range, protection rate, and coverage duration that straighten with their production goals and run the risk of resistance. Comprehending these adjustable alternatives is vital for manufacturers to effectively manage their cost threat exposure.

Furthermore, LRP is available for numerous livestock types, including livestock, swine, and lamb, making it a flexible danger monitoring device for animals manufacturers throughout different industries. Bagley Risk Management. By acquainting themselves with the details of LRP, manufacturers can make informed decisions to protect their financial investments and ensure financial stability in the face of market uncertainties

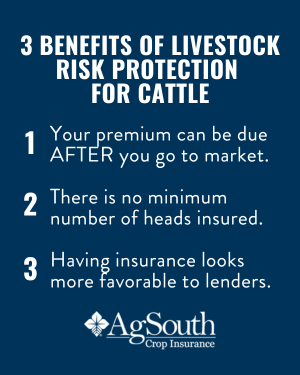

Benefits of LRP Insurance Coverage for Animals Producers

Animals producers leveraging Animals Danger Protection (LRP) Insurance policy get a calculated advantage in securing their financial investments from cost volatility and securing a steady financial ground amidst market unpredictabilities. By setting a floor on the cost of their livestock, manufacturers can mitigate the threat of substantial financial losses in the event of market slumps.

In Addition, LRP Insurance policy supplies manufacturers with peace of mind. In general, the benefits of LRP Insurance for animals manufacturers are considerable, using an important tool for taking care of threat and making certain monetary safety and security in an unpredictable market environment.

Just How LRP Insurance Policy Mitigates Market Dangers

Reducing market risks, Animals Threat Defense (LRP) Insurance coverage provides animals producers with a reliable guard against price volatility and economic uncertainties. By supplying security versus unforeseen rate decreases, LRP Insurance assists producers protect their financial investments and preserve monetary stability when faced with market variations. This sort of insurance policy allows animals manufacturers to lock in a rate for their animals at the beginning of the plan period, making sure a minimum cost level no matter market adjustments.

Actions to Safeguard Your Livestock Investment With LRP

In the realm of agricultural danger administration, carrying out Livestock Risk Protection (LRP) Insurance involves a tactical process to safeguard financial investments versus market changes and uncertainties. To protect your animals investment effectively with LRP, the initial action is to examine the particular risks your procedure deals with, such as price volatility or unanticipated climate events. Understanding these threats allows you to determine the insurance coverage degree needed to protect your financial investment adequately. Next off, it is important to research study and select a reliable insurance policy supplier that provides LRP plans tailored to your livestock and service needs. As soon as you have picked a company, carefully evaluate the plan terms, conditions, and insurance coverage limitations to guarantee they align with your threat monitoring objectives. Furthermore, routinely keeping track of market fads and adjusting your coverage as required can assist optimize your protection against prospective losses. By complying with these actions diligently, you can improve the protection of your livestock financial investment and browse market unpredictabilities with self-confidence.

Long-Term Financial Safety With LRP Insurance Policy

Ensuring enduring economic stability through the usage of Livestock this article Danger Defense (LRP) Insurance policy is a sensible long-term method for farming producers. By incorporating LRP Insurance coverage right into their danger management plans, farmers can protect their livestock investments versus unanticipated market changes and negative events that might threaten their monetary health over time.

One secret benefit of LRP Insurance for long-lasting economic protection is the peace of mind it supplies. With a trustworthy insurance plan in position, farmers can reduce the economic threats connected with unstable market problems and unanticipated losses due to aspects such as disease episodes or all-natural catastrophes - Bagley Risk Management. This stability allows manufacturers to concentrate on the day-to-day procedures of their animals business without continuous fret about potential monetary obstacles

Moreover, LRP Insurance provides a structured method to handling danger over the long-term. By establishing certain protection degrees and picking suitable recommendation periods, farmers can tailor their insurance plans to straighten with their financial goals and take the chance of tolerance, guaranteeing a safe and secure and lasting future for their livestock procedures. In final thought, investing in LRP Insurance is a positive technique for farming manufacturers to achieve lasting financial protection and safeguard their incomes.

Conclusion

To conclude, Animals Danger Defense (LRP) Insurance policy is a valuable device for animals manufacturers to mitigate market threats and protect their investments. By comprehending the benefits of LRP insurance and taking steps to implement it, producers can attain lasting monetary safety and security for their procedures. LRP insurance policy offers a safeguard against rate variations and makes certain a level of security in an uncertain market setting. It is a smart choice for safeguarding livestock investments.

Report this page